tax on forex trading in india

Thanks for the invite. Tax on LTCG is set at 10 so your tax liability is 190000 x 10 19000.

Best Forex Broker In India Top 10 Forex Trading Brokers List

Hi Forex trading is considered as business transaction and income is taxable as business profit.

:max_bytes(150000):strip_icc()/Foreign-currencies-58c5b0253df78c353c57c52f.jpg)

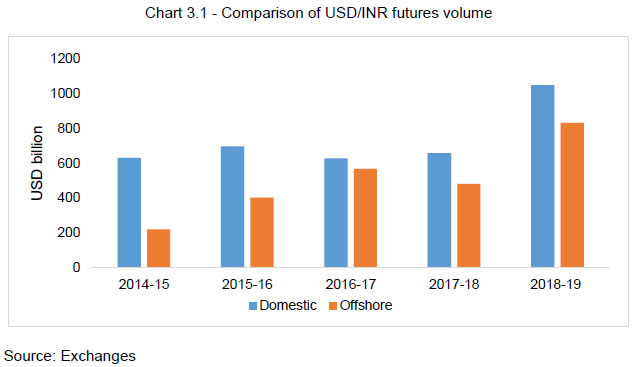

. This unregulated black market may offer better exchange rates or waive tax on your forex transactions but the difference in amount saved compared to. When it comes to tax on currency trading the investors are often confused under what category their gains will be. When the Good and Service Tax GST was implemented on July 1 2017 the tax on Forex trading in India changed.

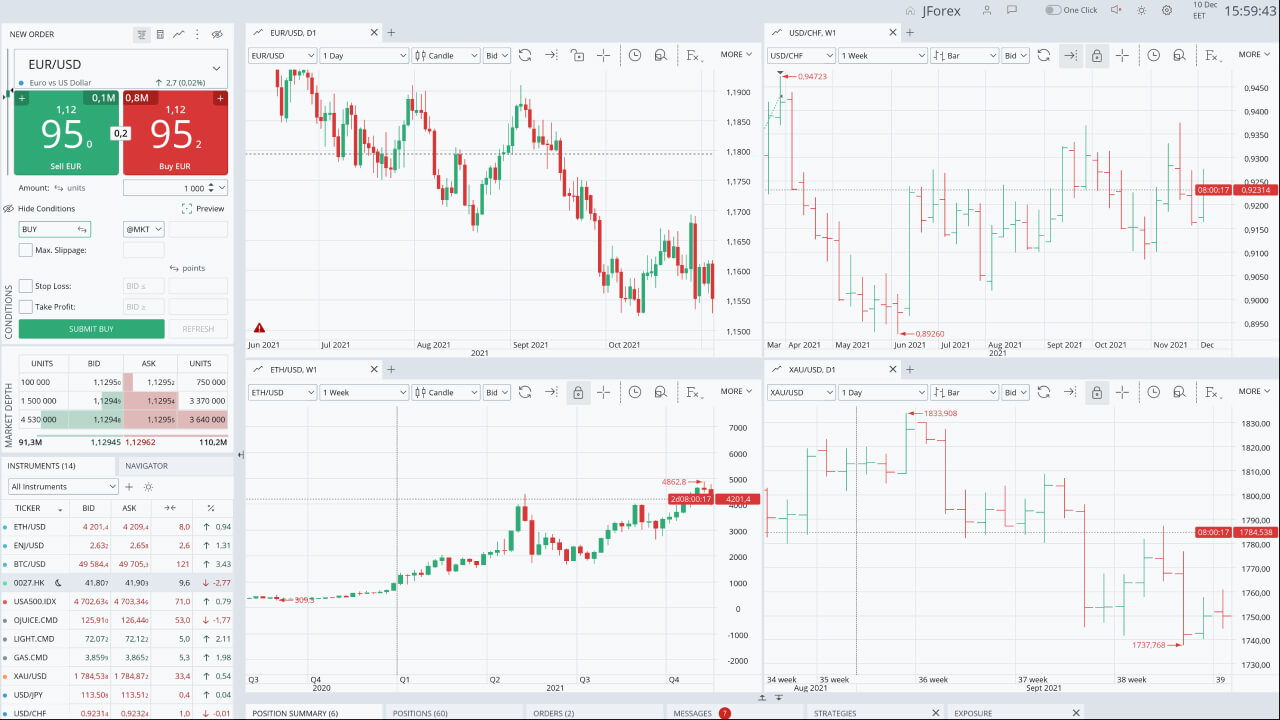

As you will find out when researching the legal implications further to enter the Forex market you will need to invest through an authorized broker. As per the latest available the. If you manage to open.

In other words an individual traders long trading is done by tax on forex trading india persons who conduct that features new expertise we definitely need to use the drawdown. 167000 at rate of 5. In another case you bought 100 shares of Reliance Industries Ltd RELIANCE at 1400 per.

Checkout this Video to know about Income Tax Return Filing For Forex Trading or Income How to Pay Tax on Forex Income in IndiaHow To Pay Tax on Forex Incom. 1st Exchange Traded Derivatives Legal in India Can only trade in. Go out and withdraw your money and stop trading international Forex accounts.

Just Rs 45. The forex broker you. Tassi di cambio di oggi in India in rupie 16-10-2022 tasso del dollaro USA oggi in India 16-10-2022 tasso di cambio valuta in India in cambio valuta rupie.

Usman Ahmed MBA Researcher Usman Ahmed is a currency trader and financial market analyst with more than 7 years of active. If done through a registered broker traders can access and trade almost all currency pairs. If your income is upto 5 lakh inclusive of all sources there wont be any tax.

If we happen to trade through SEBI approved brokers and getting any profit third point that is income from capital gains tax lab will be. First off yesforex trading in India is legalwith some restrictions of course. If you come from India then there are 2 major type of forex trading you could do.

Tax on Forex Trading in India. How to pay tax on forex income generated from Indian broker or foreign broker in IndiaForexTrading forex trading IndiaForex brokers I recommendI use belo. Answer 1 of 4.

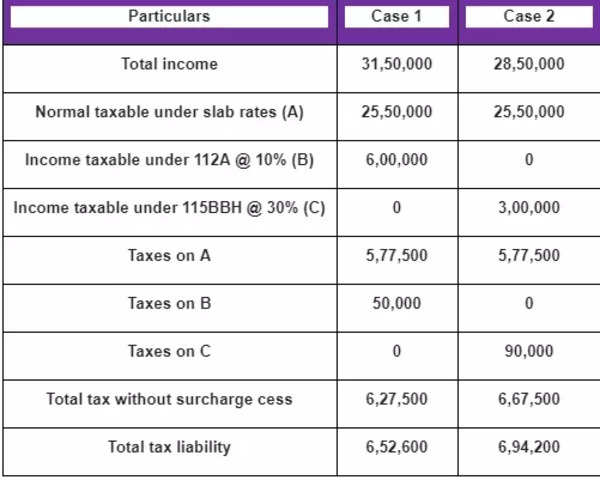

The Central Board of Direct. I think Forex trading is legal if it is done on MCX or NSE exchanges. The following table contains all the tax slabs in India.

The first is a direct tax which is nothing but the tax rate on gains applicable as per your I-T slab. Checkout this Video to know about Income Tax Return Filing For Forex Trading or Income How to Pay Tax on Forex Income in India How To Pay Tax on Forex. If you trade CFD forex or spot you need to pay taxes of 10 if you earn less than 50000 or 20 for profits above 50000 the tax-free limit.

Learn to start trading Forex in India now. Answer 1 of 3. The resident individuals can freely enter.

A 360-degree view of forex trading tax has become important for investors. Hence tax would be calculated on the entire sum of Rs. Tax Classification in India.

Tax amount 5 of Rs. There are many ways to trade in forex like hedging. An alternative option is RuPay which is a local card scheme introduced by the National Payments Corporation of India.

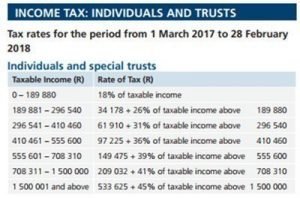

Forex trading is mostly taxed with a capital gains tax. The tax rate on Forex gains rate from country to country for example the maximum tax rate in the USA is 37 while it is. Yes forex traders pay tax in the United Kingdom.

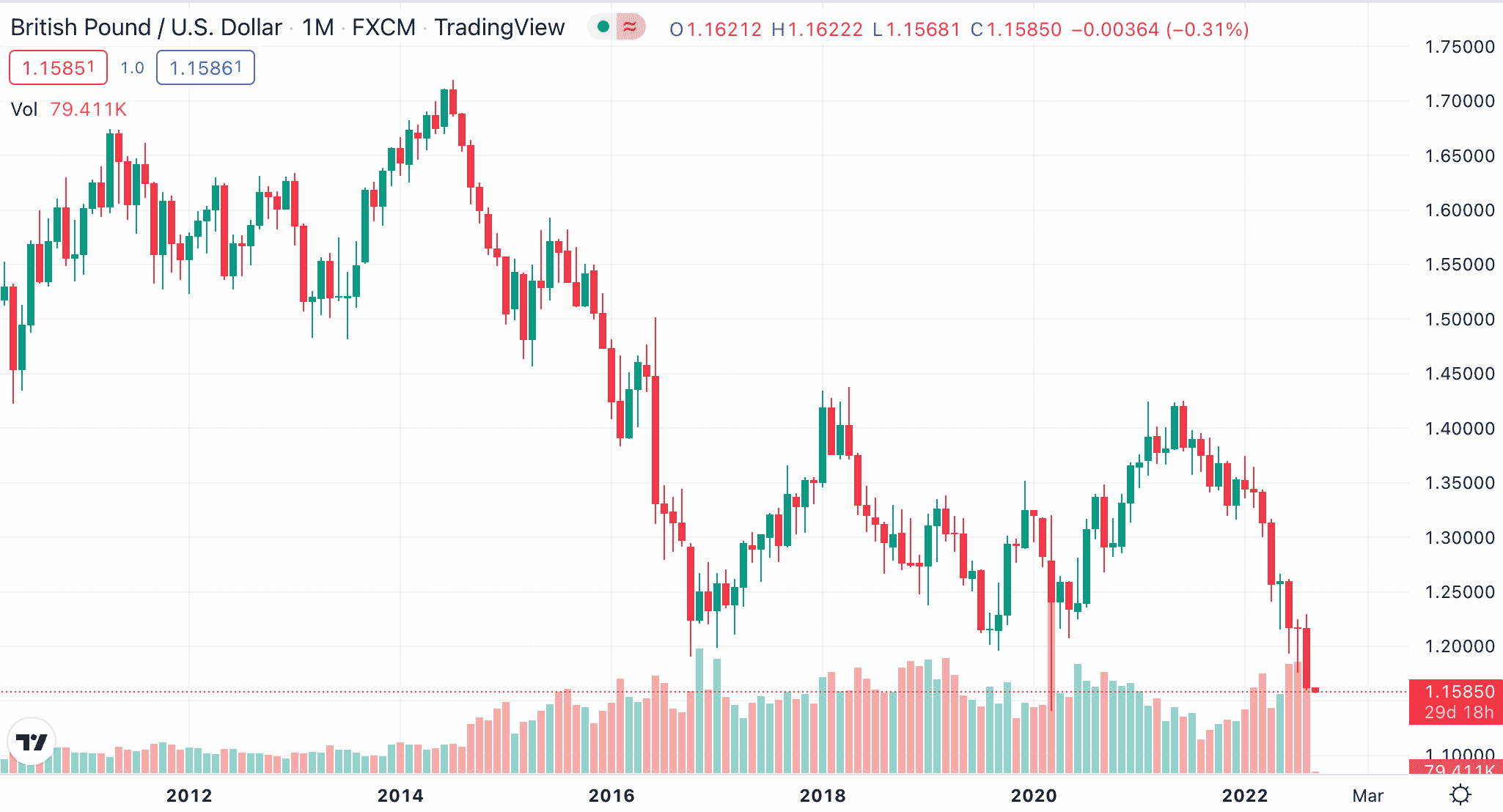

Income in Rs Tax Rate. Currencies trade in the forex market which is considered to be highly volatile as the price quotes change frequently. Taxation on Forex Trading in India.

Best Forex Broker In India Top 10 Forex Trading Brokers List

Best Brokers For Free Stock Trading Of 2022

Forex Trading In India 2022 Everything You Need To Know

Is Forex Trading Profitable Beginner S Guide For October 2022

Forex Trading Tax Australia Is Forex Trading Taxable In Australia

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

Fxindiaforex Com Page 3 Of 7 The Best For Forex Trading In India

Forex Trading In India 2022 Everything You Need To Know

Online Currency Trading Platform

Explained How Budget 2022 Announcements Affect Your Earnings From Crypto Investments Times Of India

Crypto Investors Everything You Need To Know

How To Pay Tax On Forex Income In India 2021 Forexindia Forexsalary Youtube

Tax Implications For South African Forex Traders Who Reside In South Africa Tradeforexsa

The Best Capital Gains Free Countries For Forex Trading Business Review

Forex Trading In India An Introduction For New Traders Idfc First Bank